LTC Price Prediction: Technical Breakout and Regulatory Catalysts Point to Upside Potential

#LTC

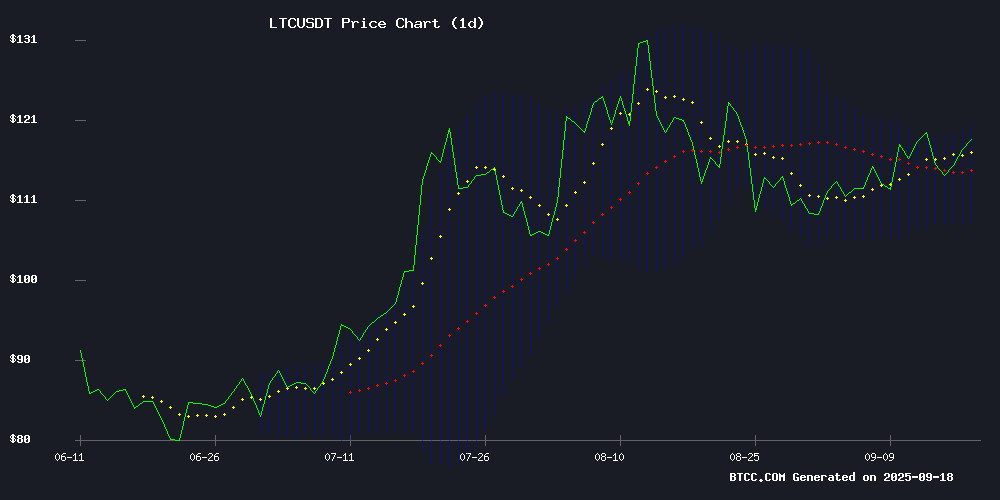

- LTC trading above 20-day MA indicates underlying bullish momentum

- Regulatory approvals and ETF expansion provide fundamental support

- Bollinger Band positioning suggests potential breakout above $120 resistance

LTC Price Prediction

LTC Technical Analysis: Bullish Breakout Potential

LTC is currently trading at $117.97, positioned above its 20-day moving average of $113.88, indicating underlying strength. The MACD reading of -2.5920 versus signal line -0.5759 shows bearish momentum but with potential for convergence. Bollinger Bands suggest consolidation with price NEAR the upper band at $119.87, while the middle band at $113.88 provides support. According to BTCC financial analyst Ava, 'LTC's position above key moving averages and proximity to Bollinger upper band suggests potential for upward movement if bullish momentum sustains.'

Regulatory Tailwinds Boost Crypto Sentiment

Recent SEC approval of commodity-based trust listing rules creates favorable conditions for digital asset adoption. The surge in crypto ETF filings, including exotic offerings, demonstrates growing institutional interest. VivoPower's enhanced XRP strategy and potential Q4 ETF debuts for Avalanche and Bonk indicate expanding market diversity. BTCC financial analyst Ava notes, 'The regulatory clarity and ETF expansion provide strong fundamental support for major cryptocurrencies like LTC, though market sentiment remains cautiously optimistic amid broader macroeconomic factors.'

Factors Influencing LTC's Price

SEC Approves Generic Listing Rules for Commodity-Based Trusts, Paving Way for Digital Assets

The U.S. Securities and Exchange Commission (SEC) has greenlit new generic listing standards for commodity-based trust shares, a MOVE that streamlines the process for digital asset listings without requiring individual approvals. The decision, documented under Rule 6c-11, applies to major stock exchanges including NYSE Arca, Cboe BZX, and Nasdaq, significantly reducing approval timeframes that previously stretched for months.

SEC Chairman Paul Atkins emphasized the agency's goal to position U.S. capital markets as the global leader in digital asset innovation. "This approval removes barriers to accessibility, fostering innovation and expanding investor options," he stated. The ruling arrives as the SEC faces impending deadlines to decide on spot ETF applications for Solana (SOL), XRP, Litecoin (LTC), and Dogecoin (DOGE), with decisions expected as early as October.

The regulatory shift underscores growing institutional acceptance of digital assets, though eligibility criteria for listings remain unspecified. Market participants anticipate heightened activity across exchanges like Coinbase and Binance as the new standards take effect.

Crypto ETF Filings Surge as Issuers Push Boundaries with Exotic Offerings

A flood of cryptocurrency ETF applications hit the SEC this week, with issuers testing regulatory limits through products tied to Avalanche (AVAX), Sui (SUI), and meme coin Bonk (BONK). Bitwise, Defiance ETFs, Tuttle Capital, and T-Rex submitted five filings ranging from infrastructure plays to leveraged tokens, signaling a dramatic expansion beyond traditional Bitcoin and Ethereum products.

The filings swell an already crowded pipeline of over 92 crypto ETF applications pending SEC review, most facing October and November deadlines. "You all have no idea what's coming over next few months," warned ETF Institute co-founder Nate Geraci as the floodgates open for alternative crypto exposures.

Meanwhile, REX-Osprey prepares to launch XRP and Dogecoin (DOGE) ETFs on Thursday using the faster 40 Act structure—a regulatory workaround that bypasses typical SEC bottlenecks. Market flows show continued divergence, with Bitcoin ETFs attracting $292 million inflows while ethereum products bled $61.74 million on September 16.

VivoPower Enhances XRP Strategy with Discounted Swaps and Equity Deals

VivoPower International is aggressively expanding its XRP holdings through a dual-pronged approach of token swaps and Ripple Labs equity acquisitions. The strategy aims to secure XRP at the lowest possible average cost, leveraging discounted conversions from mining operations and direct purchases. XRP currently trades near $3, with a market capitalization of approximately $182 billion.

The company's pivot to XRP gained momentum in May with a $121 million private placement involving Saudi royalty and the appointment of former Ripple board member Adam Traidman as advisory chairman. By June, VivoPower had secured BitGo as its exclusive custodian for XRP acquisitions and announced a $100 million yield initiative with Ripple-backed Flare Network.

August saw further commitment with definitive agreements to purchase $100 million worth of Ripple Labs equity. This institutional-grade treasury management approach demonstrates how altcoin markets are attracting sophisticated capital deployment strategies.

Cryptocurrency ETFs In Q4: Avalanche, Bonk, to Make Debuts?

The cryptocurrency ETF landscape is poised for significant expansion in Q4 2025, with a wave of new filings targeting altcoins like Avalanche (AVAX) and Bonk (BONK). This follows the SEC's historic 2024 approval of Bitcoin and Ethereum ETFs, signaling growing institutional acceptance of digital assets.

Nate Geraci, president of NovaDius Wealth Management, predicts a flood of ETF approvals in coming months. Notable filings include Bitwise's AVAX ETF and Tuttle's Income Blast ETFs covering BONK, Litecoin (LTC), and Sui (SUI). The surge reflects increasing demand for diversified crypto exposure among traditional investors.

Regulatory winds appear favorable under the TRUMP administration, which has taken a supportive stance toward cryptocurrency innovation. Market observers anticipate these developments could further bridge the gap between traditional finance and digital assets.

Crypto Market Holds Steady as Bitcoin and MYX Finance Lead Gains

The global cryptocurrency market remains resilient, with its total capitalization edging toward the $4 trillion mark. A $38 billion surge over the past day has pushed valuations to $3.99 trillion, though the critical $4.01 trillion resistance level continues to loom large. Breaching this barrier could unlock upward momentum toward $4.05 trillion, while failure may confine trading to a $3.94-$4.01 trillion range.

Bitcoin maintains its dominance at $116,675, firmly anchored above the $115,000 support floor. The next battleground lies at $117,261—converting this level to support could catalyze a run toward $120,000. Conversely, rejection might precipitate a retreat to $115,000 or even $112,500, reviving volatility.

MYX Finance emerges as the altcoin standout, rallying 12% to $11.81. The token's ability to establish $11.52 as support will determine whether it challenges $14.46 or falls back to $9.91 under selling pressure.

Institutional adoption accelerates as Banco Santander's Openbank debuts crypto trading in Germany, initially supporting Bitcoin, Ether, and select altcoins. Separately, Circle's partnership with Hyperliquid brings Native USDC integration to HyperEV through the CCTP V2 framework.

How High Will LTC Price Go?

Based on current technical indicators and market developments, LTC shows potential for upward movement toward the $125-$130 range in the near term. The combination of technical positioning above key moving averages and supportive regulatory news creates a favorable environment. However, traders should monitor MACD convergence for confirmation of bullish momentum.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $117.97 | Neutral/Bullish |

| 20-day MA | $113.88 | Support |

| Bollinger Upper | $119.87 | Resistance |

| MACD | -2.5920 | Bearish but Improving |